trust capital gains tax rate 2020 table

Tax Tables 2020 Edition 2020 Tax Rate Schedule Tax Rates on Long-Term Capital Gains and Qualified Dividends 2020 Edition TAXABLE INCOME BASE AMOUNT OF TAX PLUS MARGINAL. However note that Sec.

Stock Mover Of The Day 10 July 19 Interglobe Aviation Limited Stock Advisor Stock Market Share Market

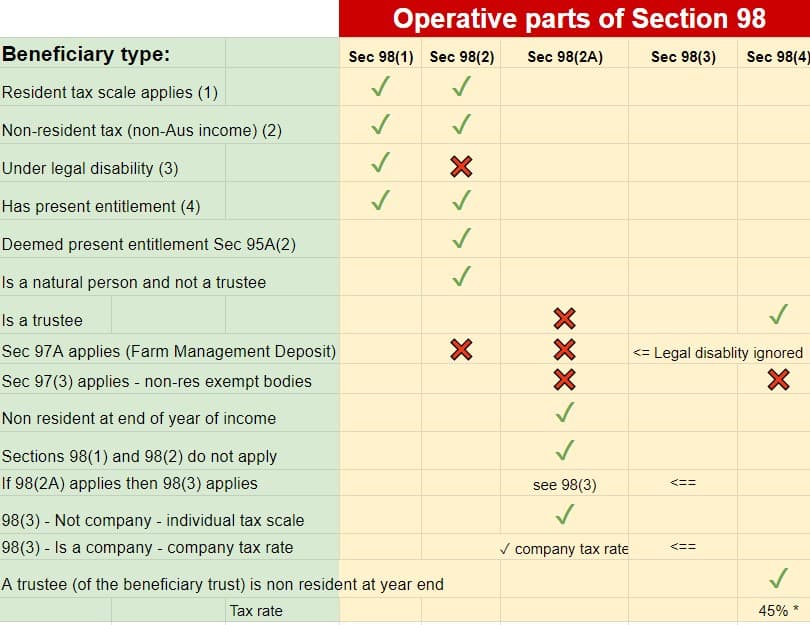

20 for trustees or for.

. 10 percent of taxable income. 641 c 2 sets out the specific deductions available to ESBTs. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

Tax changes enacted in 2013 included a top tax bracket for trusts of 396 on undistributed income adjusted for inflation latest year amount is shown in the above tax table for trusts and increases the long-term capital gains rate from 15 to 20 for the top tax bracket. Qualified dividends and capital gains on assets held for more than 12 months are taxed at a lower rate called the long-term capital gains rate. Capital gains rates for individual increase to 15 for those individuals with income of 40001 and more 80001 for married filing joint 40001 for married filing separate and 53601 for head of household and increase even further to 20 for those individuals with income over 441450 496600 for married filing joint 248300 for.

IRS Form 1041 gives instructions on how to file. 260 plus 24 percent of the excess over 2600. This along with the rate reduction may reduce the tax paid by ESBTs on S corporation income from a maximum of 396 in tax year 2017 to a potential effective rate of 296 starting in tax year 2018 taxable income reduced to 80 times 37 top rate.

Estates and Trusts Taxable Income 0 to 2600 maximum rate 0 2601 to 12700 maximum rate 15 12701 and over maximum rate 20. In 2020 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. Single filers with incomes more than 441500 will get hit with a 20 long.

Estates and trusts 25400 84800 AMT Tax Rates Jul MARRIED FILING SEPARATELY ALL OTHERS. If taxable income is. So for example if a trust earns 10000 in income during 2021 it would pay the following taxes.

The maximum tax rate for long-term capital gains and qualified dividends is 20. The tax rate works out to be 3146 plus 37 of income over 13050. 10 percent of taxable income.

This gives you a 2000 capital gain and because you owned the stock for more than a year you can treat it as a long-term capital gain. State taxes are in addition to the above. Over 2600 but not over 9450.

The highest trust and estate tax rate is 37. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income. For trusts in 2022 there are three long-term capital.

Over 9450 but not over 12950. For tax year 2020 the 20 rate applies to amounts above 13150. 0 2650.

The remaining amount is taxed at the current rate of Capital Gains Tax for trustees in the 2021 to 2022 tax year. Discover Helpful Information and Resources on Taxes From AARP. Trust tax rates are very high as you can see here.

Ad Compare Your 2022 Tax Bracket vs. The 0 rate applies to amounts up to 2650. 1904 plus 35 percent of the excess over 9450.

The rate remains 40 percent. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 518400 and higher for single filers and 622050 and higher for married couples. 260 plus 24 percent of the excess over 2600.

The 2020 rates and brackets for the income of an Estate or trust. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed with the Affordable Care Act. If taxable income is.

Thursday March 3 2022. The 0 and 15 rates continue to apply to amounts below certain threshold amounts. Over 2600 but not over 9450.

The tax rate schedule for estates and trusts in 2020 is as follows. Trust capital gains tax rate 2020 table. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income.

Capital gains tax rates on most assets held for a. Your 2021 Tax Bracket to See Whats Been Adjusted. 2020 Federal Income Tax Rates for Estates and Trusts.

Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000. The standard rules apply to these four tax brackets. Capital gains and qualified dividends.

Table of Current Income Tax Rates for Estates and Trusts 202 1. The capital gain tax rates for trusts and estates are as follows. An irrevocable trust needs to get a tax ID EIN number and pay taxes each year by filing a 1041 tax return.

2020 Federal Income Tax Brackets and Rates. Over 9450 but not over 12950. Most single people will fall into the 15 capital gains rate which applies to incomes between 40001 and 441500.

2022 Long-Term Capital Gains Trust Tax Rates. It applies to income of 13050 or more for deaths that occurred in 2021. However long term capital gain generated by a trust still maxes out at 20 plus the 38 when taxable trust income exceeds 13050.

Canvas Jpg In 2020 Home Mortgage Eagle Homes New Homes For Sale

Schedule K 1 Tax Form What Is It And Who Needs To Know Tax Forms Income Tax Filing Taxes

Pin By Ednaghyslenekurabayashi On Feliz Aniversario Budgeting Homeowners Insurance Financial Wellness

2021 Estate Income Tax Calculator Rates

Trust Tax Rates 2022 Atotaxrates Info

Woocommerce Eu Vat B2b Stylelib Woocommerce Plugins Wordpress

Redi Ceo Says High Property Taxes Likely Deterring Growth In Pocatello Local Idahostatejournal Com Property Tax Pocatello Economic Development

Professional Home Buyer In 2020 Real Estate Investment Trust Real Estate Agent Investment Property

Professional Home Buyer In 2020 Real Estate Investment Trust Real Estate Agent Investment Property

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

If They Haven T Already Arrived Property Valuations Are Coming Your Way Soon If You Believe The Market Value Of Grayson County Property Valuation Real Estate

Capital Gains Tax What Is It When Do You Pay It

Redi Ceo Says High Property Taxes Likely Deterring Growth In Pocatello Local Idahostatejournal Com Property Tax Pocatello Economic Development

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

What Will Happen If You Can T File Your Tax On April 15 Tax Day Filing Taxes Tax Deadline

Pin By Ednaghyslenekurabayashi On Feliz Aniversario Budgeting Homeowners Insurance Financial Wellness

Taxation Changes In Indonesia Under Tax Regulation Harmonization Law